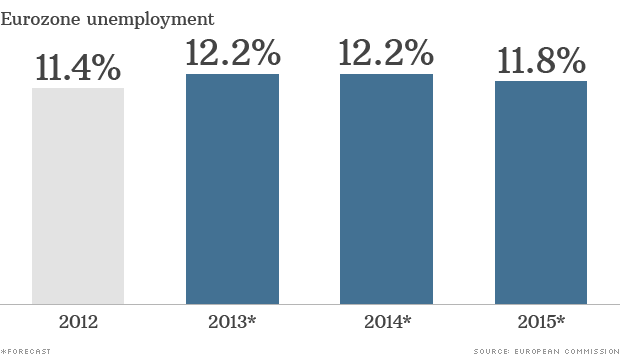

Europe's crisis is not over yet and

unemployment will stay at record levels above 12% until 2015, the European

Union said Tuesday.

The eurozone emerged from a recession lasting six quarters earlier

this year but has struggled to gain momentum since. The culprits: weak domestic

demand and a morechallenging environment for

exporters.

Gross domestic product across the 17-nation region will shrink

by 0.4% in 2013, after contracting by 0.6% in 2012.

"The recovery is expected to continue, and to gather some

speed next year. However, it is too early to declare the crisis over," the

European Commission said in its semi-annual economic forecast.

"External demand is expected to pick up over the coming

quarters, but less than earlier expected, on account of a weakened outlook for

growth in emerging market economies and the appreciation of the euro."

The euro hit a two-year high against the dollar last week.

The Commission trimmed its eurozone GDP growth forecast for 2014

to 1.1%, from 1.2% earlier this year.

The impact of harsh austerity measures in 2011 and 2012 has

begun to fade this year, and eurozone government spending will rise in 2014,

but paying down debt remains a priority for companies and households.

That means less money available for investment and spending, so

any recovery in domestic demand will be very gradual. Lending to companies

continues to contract, providing another obstacle to faster growth.

"We cannot yet declare victory, and must not fall into the

trap of complacency," Olli Rehn, the EU's top finance official, told

reporters.

Governments must stay the course of economic reform to boost

growth and create jobs,

he said.

Economists have called recently for the European Central Bank to

cut interest rates to a new record low -- as early as this week but by December

at the latest -- to reduce the risks of a Japan-style period of deflation and stagnation.

Deflation is a broad decline in the price of goods and services.

It can tip economies into a downward spiral as consumers and businesses delay

purchases in anticipation of further falls to come. It also increases the value

of debt, a big risk for the eurozone where government debt is expected to hit

96% of GDP next year.

Rehn said the risk of deflation seemed "remote" but

noted ECB President Mario

Draghi'srepeated commitment to act if necessary to support the

recovery.

Apart from making the right call on monetary policy, Draghi is

under enormous pressure to restore credibility in Europe's banking industry

with a 12-month health check of

the region's biggest lenders.

The ECB is due to assume responsibility for supervising Europe's

top banks late next year, a first step toward a banking union that policymakers

say is essential to repairing the damage created by the 2008 financial crisis.

Previous rounds of stress tests, including one in 2010, failed

to identify major weaknesses among some banks in countries including Spain and

Ireland.

Rehn said he believed the checks led by the ECB would be much

more rigorous.

"Mario Draghi has a very strong incentive not to receive

any crap in his hands," he said.

No comments:

Post a Comment